Challenge

How can we motivate young customers to engage in private retirement provision and to become active at an early stage together with HUK-COBURG?

Currently, young people have a huge problem to start engaging in retirement planning, even though most of them are aware that in Germany the state pension is not sufficient due to the demographic change. With solely relying on the state pension, young people will most likely not be able to keep their standard of living in retirement. People should, therefore, act as early as possible. However, today only about half of the German population makes private financial provisions.

HUK-COBURG, a German insurance company with a traditional focus on car insurances, is aware of this situation and wants to motivate people to start engaging in retirement provision as early as possible.

Insights

We learned that many people begin to realize the importance of retirement planning after significant changes in their lifes. For our persona Lisa such a significant change is the start of her professional career, other events can be starting a family or building a house. Although people become aware of the importance of retirement planning after such significant life event, people still don't act.

Lisa (25)

Why do they not become active?

We learned that, among other things, the three most important aspects that need to be addressed so that young people start engaging in retirement planning are high entry barriers and inflexibility, intangibility, and missing guidance.

High entry barriers

Young people perceive retirement planning as complex, inflexible, and time-consuming. Our solution has to be digital and easy to use. Additionally, customers need flexible insurance that suits every life situation and can be adapted accordingly.

Intangibility

Many people find it hard to imagine their standard of living in retirement with their current pension. They only see numbers and don't understand the implications. Thus they need a way to have a better understanding of their future standard of living.

Missing guidance

Keeping an overview of your current financial situation can be difficult. Therefore it is crucial to provide guidance for young people for them to understand their possibilities for saving today.

Solution

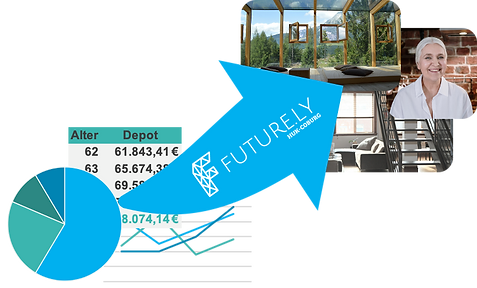

Future.ly presents personal real-life scenarios for understandable retirement planning and an easy and flexible way to invest savings for your retirement.

Future.ly enables users to jump into their future by giving them an insight into how their standard of living might look like in their future. Our solution provides people with the possibility to shape their life in retirement according to their ideas and visions.

But many people don't have a complete understanding of their current financial situation and thus their saving potential. Therefore, Future.ly guides them to a better understanding by providing support with the Budget planner.

After people gained an insight into their current financial possibilities and the implications on their standard of living in retirement, they can start with shaping their life. Future.ly is a flexible insurance that can be adapted to every life situation.

Scan me with your camera and jump into your future!

Our solution is developed for phones. You're on your phone? Just click on the QR code.

Features

Impact

The possibility to gain an understanding of the impact of today's savings on the living situation in retirement instead of just being confronted with pure numbers allows customers to relate to their retirement. Future.ly encourages people to shape their future according to their personal ideas and vision. Other than most insurances Future.ly impacts customers on an emotional level and provides them a flexible and tangible service to save for their retirement.

Student Team

Martin Meier

Digital Health

Hasso Plattner Institute

Berit Weldner

Industrial Engineering and Management

Karlsruhe Institute of

Technology

Johannes Hötter

Data Engineering

Hasso Plattner Institute

Nils Kleber

Information Systems

Karlsruhe Institute of

Technology

Benedikt Blumenstiel

Information Systems

Karlsruhe Institute of

Technology

Pascal Crenzin

IT Systems Engineering

Hasso Plattner Institute